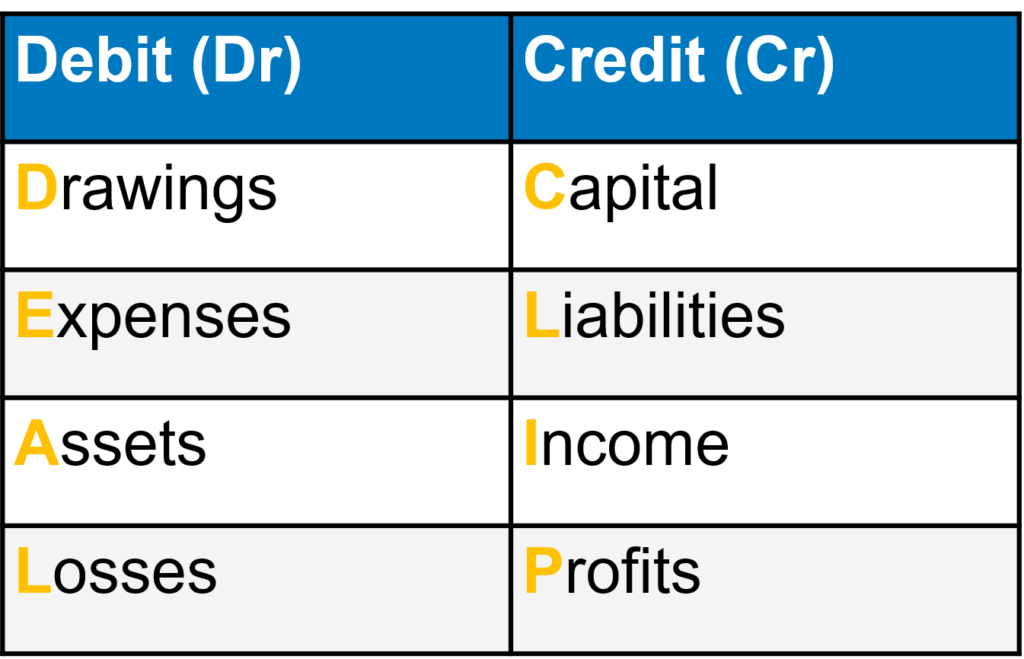

In order to decide when to write on the debit side of an account and when to write on the credit side of an account. There are two approaches:-

(I) American approach or Modern approach:

The rules of debit and credit depend on the nature of an account. For this purpose, all the accounts are classified into the following five categories in the American approach:

- Assets Accounts.

- Liabilities Accounts.

- Capital Accounts.

- Revenue or Income accounts.

- Losses or Expenses accounts.

While discussing an accounting equation, we have studied that if there is an increase or decrease in one account, there will be equal decrease or increase in another account. Accordingly, following rules of debit or credit in respect of the various categories of accounts can be obtained-

(i) Assets Accounts:

When there is an increase in the amount of an asset, such an increase is recorded on the debit side of the asset account and if there is a reduction is reduction is recorded on the credit side of the asset account.

| Rs. | Rs. | ||

| Increase in asset will be recorded on this side. | Decrease in asset will be recorded on this side. |

(ii) Liabilities Accounts:

When there is an increase in the amount of a liability, such as increase will be recorded on the credit side of the liability account. On the contrary, if there is a reduction in the amount of a liability, it will be recorded on the debit side of the liability account.

| Rs. | Rs. | ||

| Decrease in liability will be recorded on this side. | Increase in liability will be recorded on this side. |

(iii) Capital Account:

An increase in the capital is recorded on the credit side and the decrease in the capital is recorded on the debit side. Suppose, the proprietor introduces the additional capital in the business, the capital account will be credited. If the proprietor withdraws some money for his personal use, i.e , makes drawings, the capital account will be debited.

| Rs. | Rs. | ||

| Decrease in capital will be recorded on this side. | Increase in capital will be recorded on this side. |

(iv) Revenue or Income Accounts:

All increases in the gains and incomes are recorded on the credit side of the concerned income account as it leads to increase in the capital. If there is a reduction in any gain or income, the account concerned will be debited, as it leads to decrease in the capital .

| Rs. | Rs. | ||

| Decrease in gains and incomes will be recorded on this side. | Increase in gains and incomes will be recorded on this side. |

(v) Losses or Expenses Accounts:

All increases in the losses and expenses are recorded on the debit side of the concerned expenses account as it leads to decrease in the capital. On the contrary, the reduction in expenses is recorded on the credit side.

| Rs. | Rs. | ||

| Increase in losses and expenses will be recorded on this side. | Decrease in losses and expenses will be recorded on this side. |