financial protection or reimbursement against losses.

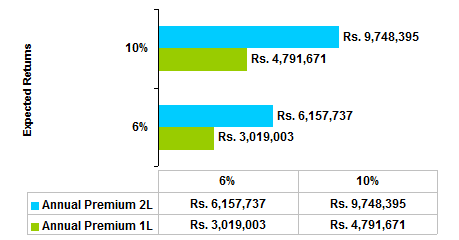

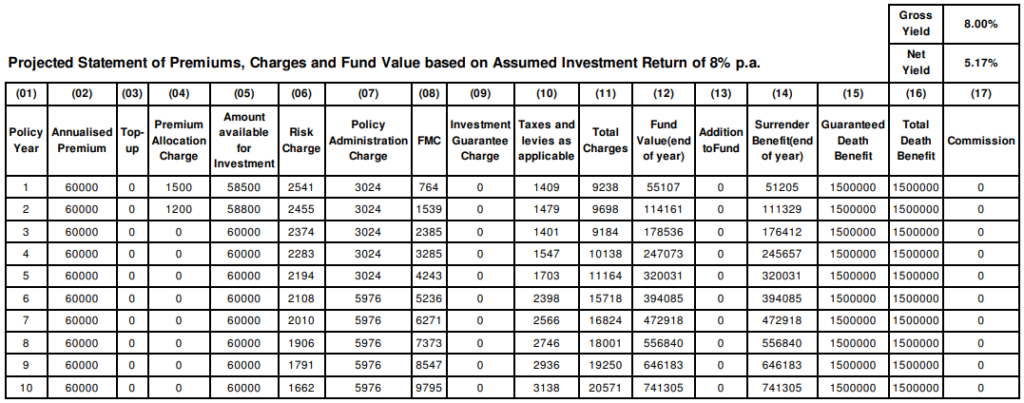

HDFC LIFE ProGrowth Plus:

- HDFC Life ProGrowth Plus is a regular premium unit linked insurance plan. In this plan you can choose your regular premium and the investment fund(s).

- We will then invest your regular premium, net of premium allocation charges in your chosen fund(s) in the proportion you specify.

- At the end of the policy term, you will receive the accumulated value of your fund(s). In case of unfortunate death of Life Assured during the policy term, the

- $ nominee will receive the greater of Sum Assured (less withdrawals ) or fund value.

POWER WORDS : a person or company considered according to how safe it is to lend them money or give them insurance or credit

Eligibility Criteria:-

EASY STEPS TO YOUR OWN PLAN:

- STEP1: Choose the plan options , your regular premium & level of protection .

Plan Option Cover

Life Option Death Benefit

Extra Life Option Death Benefit + Accidental Death Benefit

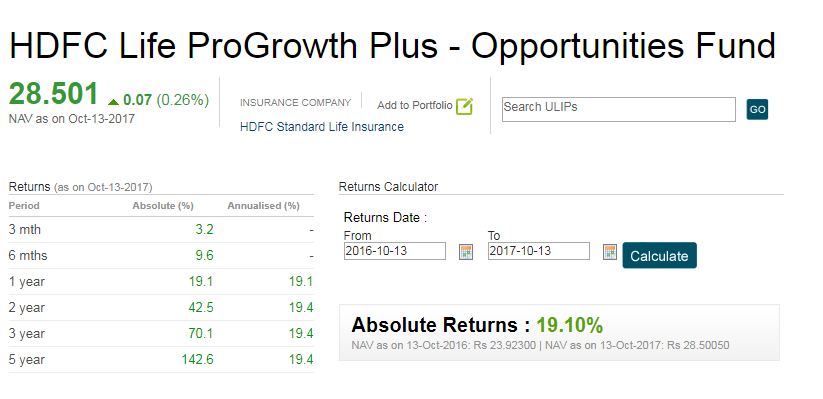

STEP 2: Choose your investment plans:

- Balance your level of risk and return, making the right investment choice is very important and you are responsible for the choices you make.

- We have 10 funds that give you the potential for:

- Higher but more variable returns; or Lower but more stable returns over the term of your policy.

For book a plan – https://www.hdfclife.com/ulip-plans/progrowth-plus-ulip-plan

For brochure click on this link: https://www.hdfclife.com/content/dam/hdfclifeinsurancecompany/products-page/brochure-pdf/PP10201710536-HDFC-Life-ProGrowth-Plus-Retail-Brochure.pdf

Online Premium Payment

https://onlinepayments.hdfclife.com/HDFCLife/quick_pay.html

How can I claim my HDFC maturity amount?

- Call (All Days, from 9 am to 9 pm, Toll free) 1800-266-9777.

- Request call back (Missed Call) 1800-315-7373.

- Call (For NRI customers, All Days, Local charges apply) +91-8916613503.

- Email. buyonline@hdfclife.in.

- SMS. SMS LIFE to 56161.

Can I surrender HDFC Life policy?

Reason(s) for policy surrender and the surrender form needs to be submitted at the nearest HDFC Life Insurance branch, along with the following documents: Original policy documents. Canceled cheque with the policyholder’s name on it.

When can I withdraw my HDFC Life policy?

You can exit from ULIP after 5 years; however, it is not advisable even after lock-in period ends. To reap the benefits, you should continue and stay invested for a long period say 15-20 years. If you think that the funds are not performing, you may want to go for switching your funds.