A forex card is your best friend on your travels abroad. It is the easiest way to carry foreign currency and pay for expenses on your overseas trips.

With a forex card in your wallet, you need not carry wads of cash on your sight-seeing trips in a new country. Forex cards are considered one of the safest ways to carry money on your international travels.

What are the different types of forex card?

A forex card comes with two main variants–multicurrency forex cards and single currency cards.

A multicurrency card like the HDFC Bank Multicurrency Forex Plus Card . For example, can travel with you wherever you go. You can load it with up to 23 currencies and use it across the world. You can also shuffle funds from one currency to another whenever you need via prepaid.

If you are a student, you can opt for the HDFC Bank ISIC Student Forex PlusCard, which works as a global student identity card as well as an easy way to pay for your expenses.

you can get specialized cards like the HDFC Bank Hajj Umrah Card (that caters to the unique forex needs of Hajj pilgrims).

Best Forex Cards in India:

- Thomas Cook Forex Card.

- IndusInd Bank Multi Currency Forex Card.

- HDFC Multi Currency Platinum Forex Card.

- YES Bank Multi Currency Travel Forex Card.

- Axis Bank Multi Currency Forex Card.

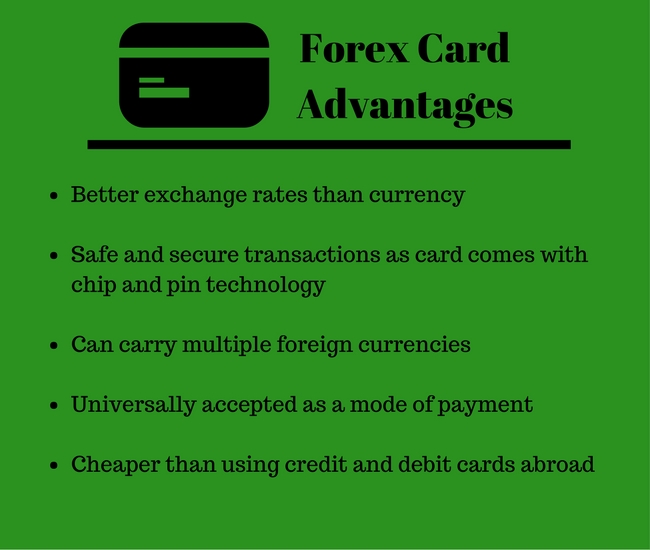

Advantages of A Forex Card:

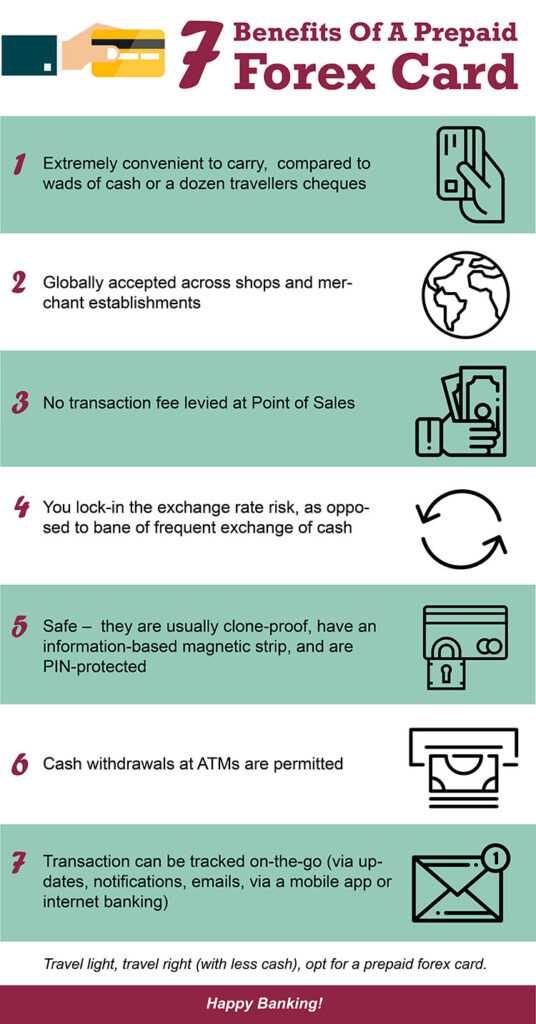

Benefits of a Forex Card:

How to Apply for A Forex Card:

- You can visit a bank branch or apply online for a card of your choice.

- Most banks and financial institutions offer different cards depending on the type of perks and benefits that can be availed.

- After selecting the card, you wish to apply for, you can either visit a bank branch with the required documentation or you could apply online if the facility is provided.

Documents Required for Forex Card:

The Basic Documents Required Are as Follows:

- Application form.

- Copy of passport (self-attested).

- Copy of visa (visas if the trip involves multiple countries).

- Airline ticket copy.

- PAN card.

How do I withdraw money from my forex card when abroad?

- When abroad, you can withdraw money from your forex card by simply visiting an ATM and choosing ‘credit card’ as the type of card. Follow the instructions on the screen in order to make your withdrawal from the card.

What is the limit of forex card?

Your Forex Card needs be loaded with an amount that is in compliance with RBI and FEMA regulations. As per those regulations, travellers can carry up to US$ 2,50,000 or equivalent worth of forex abroad in one financial year.

Can I get forex card same day?

If you are not a Savings customer, follow the steps outlined in the Forex Card online application form and, after successful completion, you can get your card delivered at your doorstep in three days. If you choose to personalize your card, you may have to wait for a week.

Which forex card is best for students in USA?

Best Forex Cards for International Students – Wise Borderless Card. Niyo Global Card. Axis Bank Forex Card.

Is visa required for forex card?

If you plan on applying for a Multi-Currency Forex Card, then you would need to have your documentation for Multi-Currency Forex Card in order. You need to submit a copy each for your application form, passport, visa etc.

FOR APPLYING A FOREX CLICK ON BELOW LINK:

https://www.hdfcbank.com/personal/pay/cards/forex-cards/multicurrency-platinum-forexplus-chip-card

Contactless Multicurrency ForexPlus card Fees and Charges:

- Following are the HDFC Bank Multicurrency ForexPlus card charges

- Issuance Fee : INR 500/- plus applicable GST

- Reload Fee : INR 75/- plus applicable GST

- Re-issuance of Card Fee : INR 100/- plus applicable GST