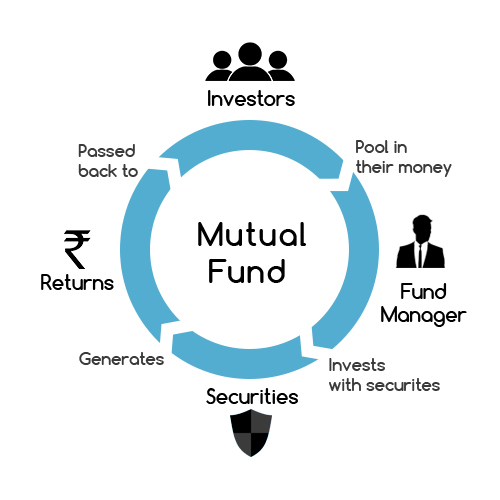

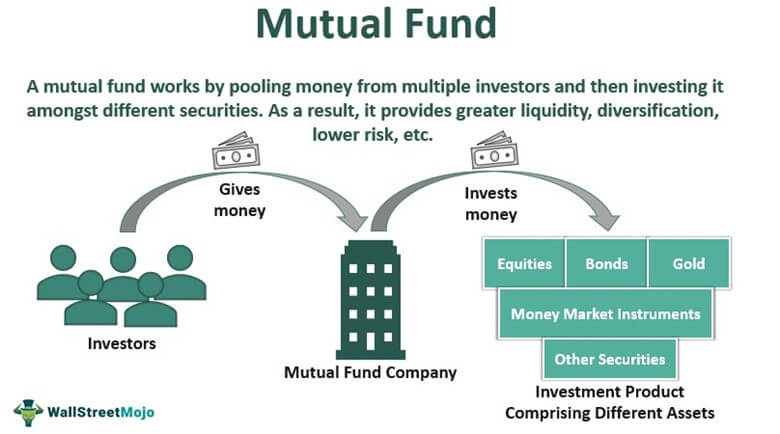

A mutual fund is a company that pools money from many investors and invests the money in securities such as stocks, bonds, and short-term debt. Investors buy shares in mutual funds. Each share represents an investor’s part ownership in the fund and the income it generates.

How do you make money in mutual funds?

Mutual funds primarily make money through sales charges that work like commissions and by charging investors a percentage of assets under management (AUM). The Securities and Exchange Commission (SEC) requires a fund company to disclose shareholder fees and operating expenses in its fund prospectus.

What types of mutual funds are there?

- Money market funds

- Bond funds

- Stock funds

What are the benefits and risks of mutual funds?

- Dividend Payments

- Capital Gains Distributions

- Increased NAV

How to Invest in Mutual Funds?

5 Simple Steps to Invest in Mutual Funds Online

- Understand your risk capacity and risk tolerance. This process of identifying the amount of risk you are capable of taking is referred to as risk profiling.

- The next step is asset allocation. Once you identify your risk profile, you should look to divide your money between various asset classes. Ideally your asset allocation should have a mix of both equity and debt instruments so as to balance out the risks.

- Then you should identify the funds that invest in each asset class. You can compare mutual funds based on investment objective and past performance.

- Decide on the mutual fund schemes you will be investing in and make the application online or offline.

- Diversification of your investments and follow-ups are important to ensure that you get the best out of your investment.