Petty cash is a small amount of money available for paying small expenses without writing a check.

Petty Cash is also the title of the general ledger current asset account that reports the amount of the company’s petty cash.

You’ll want to ensure that the money isn’t mishandled, and you’ll want to make sure that those little expenses are accounted for when tax time rolls around. Here’s how you can set up an effective, easy-to-manage petty cash system.

Advantages of a Petty Cash Fund:

- Limits discretionary spending and preventing small purchases from snowballing into a significant annual expense.

- Allows staff members to make small, authorized purchases without filling out an expense report.

- Reduces the need for managers to pay for purchases out of pocket.

- Cuts down bookkeeping.

- Provides a convenient source of funds.

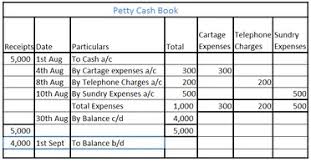

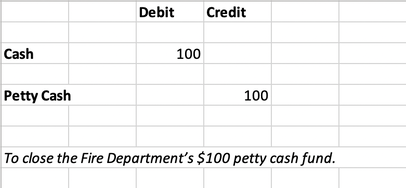

Example of Petty Cash Accounting :

A company sets up a petty cash fund and initially funds it with $300. The entry is:

Debit Credit

| Petty cash | $300 | |

| Cash | $300 |

What should Petty Cash funds be used for?

The purpose of a petty cash fund is to provide business units with sufficient cash to cover minor expenditures. The intent is to simplify the reimbursement of staff members and visitors for small expenses that generally do not Exceed $25.00, such as taxi fares, postage, office supplies, etc. See the Petty Cash Policy for additional details.

Is petty cash an asset?

Petty cash appears within the current assets section of the balance sheet.

Who handles petty cash?

petty cash custodian.

Is petty cash equivalent to cash on hand?

The petty fund is available in cash and can be considered cash on hand, the cash on hand is not always petty cash. Thus, we can say it is not equivalent to cash on hand.

More about petty cash – https://www.accountingtools.com/articles/2017/5/14/petty-cash-accounting

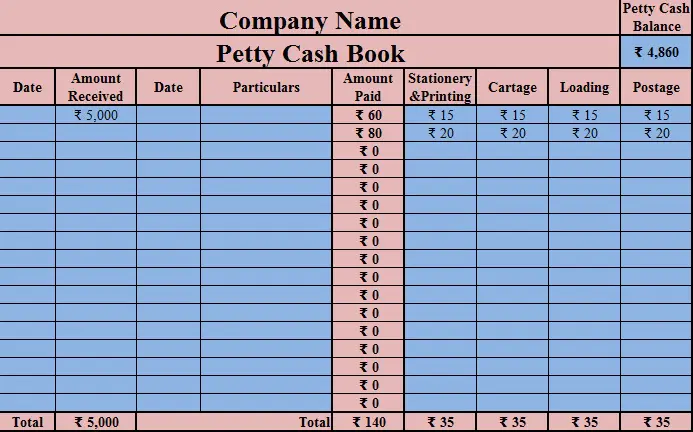

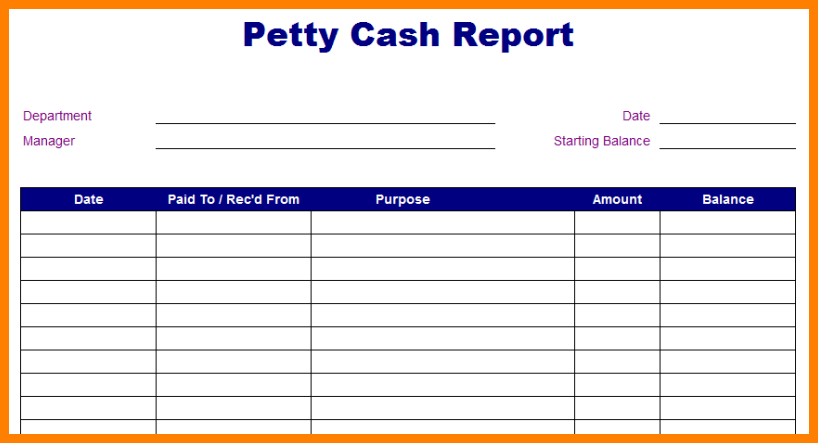

FORMAT: